Cuban actor Luis Alberto García Novoa has openly criticized the recent changes to the currency exchange market in Cuba. Despite the official rhetoric, he argues that the new rate does little to alleviate the severe economic hardship that millions on the island face daily.

In a Facebook post, García compared the exchange rates presented by the Central Bank of Cuba (BCC) with those from the independent outlet El Toque, concluding that the real difference is negligible and fails to provide any relief to the public.

"Are there truly significant differences between them? NO. NO. NO. And NO," wrote the actor, displaying screenshots of both exchange rate references from the same day.

García Novoa highlighted the government's smear campaign against El Toque, accusing it of data manipulation and political motives, while the official institutions promised "serious, reliable" rates that would benefit the public.

He explained that the disparity between the two references shows that the informal market continues to dictate the real value of money. According to El Toque, 100 U.S. dollars are traded for approximately 4,400 Cuban pesos on the street, whereas with the BCC's new official rate, those same 100 dollars—only in digital transactions and not cash—exchange for 4,100 pesos.

The difference, he pointed out, is a mere 300 Cuban pesos, an amount that barely covers "three eggs, a pack of Criollos cigarettes, or a shot of rum."

"So EL TOQUE is not wrong in its predictions," he concluded.

The Economic Reality

For the artist, the current gap between Cuban and foreign currency confirms that the law of supply and demand remains a decisive force in an economy plagued by shortages. "If goods are not produced, inflation will continue to be an inflammable inflammation," he stated.

Luis Alberto expressed his complete lack of faith in the government's economic policies. "My belief in the measures implemented over the past years has been in negative numbers for some time now. I no longer believe anything they say," he asserted.

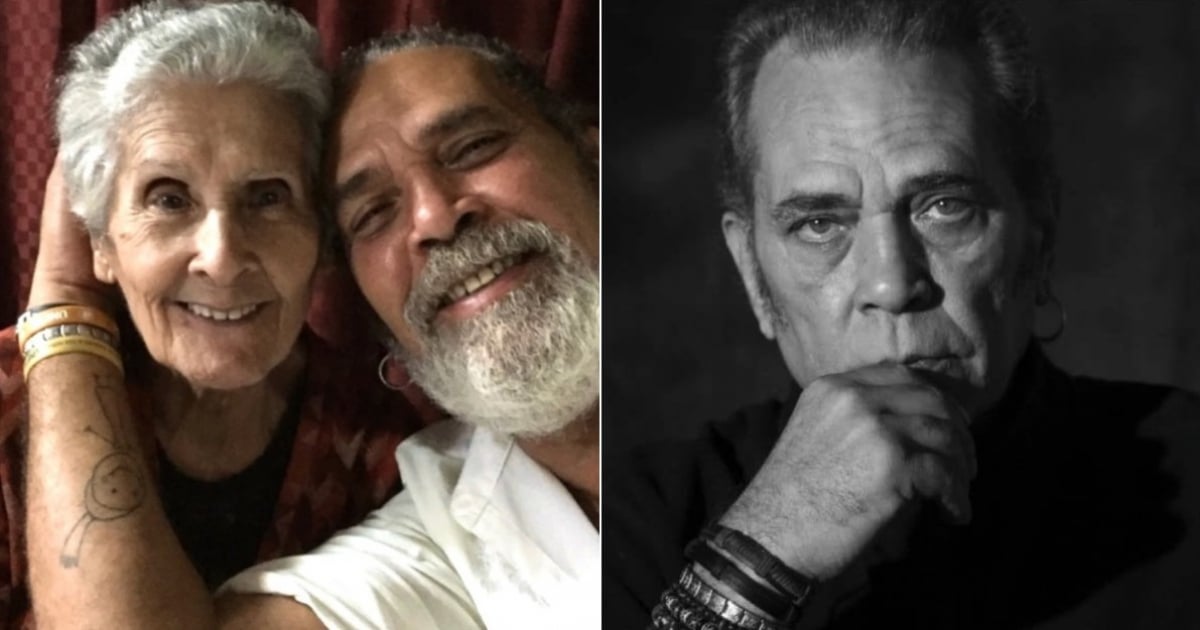

However, he lamented that many Cubans had hoped that the new exchange system would ease their everyday expenses. The most personal and painful example for him is that of his mother.

He explained that her monthly pension amounts to 2,178 Cuban pesos. Converted at El Toque's rate, it equates to about $4.95 a month; with the new official rate, it's roughly $5.31. In both scenarios, he emphasized, the amount is insufficient to purchase a carton of eggs. "It still doesn't reach the carton of eggs. I have nothing more to say," he concluded.

Background of the Protest

The actor's statements come after the Central Bank of Cuba's announcement of the gradual transformation of the currency exchange market, effective December 18. BCC President Juana Lilia Delgado explained on a televised appearance that the reform aims to correct the coexistence of multiple exchange rates, a phenomenon the regime claims causes distortions, encourages informality, and complicates banking and fiscal control.

The new framework introduces three exchange segments. A rate of 1 USD per 24 CUP is maintained, reserved for the State for essential imports like energy, food, medicine, and transportation. Another rate of 1 USD per 120 CUP is set for certain companies with external revenue and exporters.

The main novelty is a "floating" rate, supposedly determined by supply and demand, intended for natural persons and non-state management forms. While the government presents this structure as a step towards organizing the foreign exchange market and strengthening the Cuban peso, various economists have warned that the system entrenches existing inequalities.

Academic Mauricio de Miranda Parrondo questioned the logic of maintaining two fixed rates alongside a floating one, noting that the outcome favors state imports while penalizing productive sectors generating real income.

In practice, the BCC's daily publication of the "floating" rate has not displaced the informal market, which continues to set the pace for the dollar's value in Cuba. Analysts attribute this to structural issues: the shortage of foreign currency in state hands and widespread distrust of the Cuban peso.

Given the restrictions and limited availability in the official market, those receiving remittances or handling foreign currency opt for the informal market, where the price is higher, and transactions are immediate.

It is this disconnect between official announcements and everyday reality that prompted Luis Alberto García's reaction. His testimony, focused on concrete figures and the direct impact on a pension, humanized a technical debate that, for many Cubans, boils down to a single daily question: how much money is enough to live?

Understanding Cuba's Currency Crisis

Why is the Cuban exchange rate reform controversial?

The reform is controversial because it introduces multiple exchange rates, which many believe exacerbate existing economic inequalities and fail to address the underlying issues of inflation and currency devaluation.

What is the impact of the new exchange rate on ordinary Cubans?

For ordinary Cubans, the new exchange rate offers little relief as it does not significantly increase their purchasing power. Many still struggle to afford basic necessities like food and medicine.

How does the informal market affect currency value in Cuba?

The informal market plays a significant role in determining the real value of currency in Cuba, often offering rates that reflect true supply and demand, unlike the official rates which may be artificially controlled.