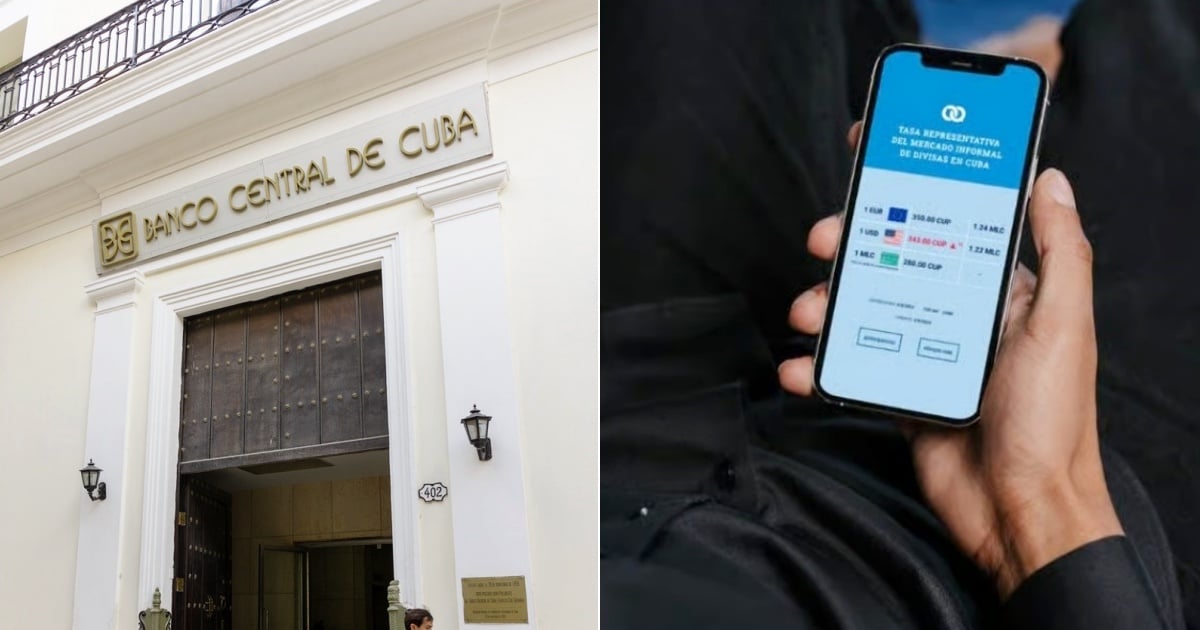

In a recent development of the institutional crackdown on the independent media outlet elTOQUE, the Central Bank of Cuba (BCC) has publicly joined the accusations spearheaded by the highest echelons of the Cuban government.

On Friday, the financial entity released a statement on its Facebook page condemning the outlet and questioning the legitimacy of its Informal Market Representative Rate (TRMi). The bank also pledged to establish an "orderly and transparent" official exchange market.

"The Central Bank of Cuba stands with Prime Minister @MMarreroCruz, Foreign Minister @BrunoRguez, and the allegations made on national television. El Toque is part of the economic aggression against our country, and it is unacceptable. It lacks economic legitimacy by operating through non-transparent mechanisms, concentrated and highly susceptible to speculation by a few economic actors influencing our currency's exchange rate," proclaimed the official post.

Additionally, the statement criticized the so-called informal market representative rate published daily by the independent outlet, labeling it a "distorted signal" that impacts "prices, expectations, and decisions" of the public.

Official Promises vs. Exchange Reality

The vow for an "orderly and transparent official exchange market" is not a novel promise.

In August 2022, the Central Bank had already announced with much fanfare the introduction of an official rate for currency purchases from the population: 1 USD for 120 Cuban pesos.

However, after applying an 8% commercial bank tax, the effective rate was set at 1 to 110.40 pesos, as explained by the bank's president, Marta Sabina Wilson González, on the state-run program Mesa Redonda.

This move was touted as a strategy to bridge the gap between the official value of the currency and the informal market. Still, it faced harsh criticism from the outset.

Back in August 2022, elTOQUE had already warned that the rate set by the government was almost identical to the black market rate (1x115 at that time) and that the measure provided no real incentives for selling foreign currency to the State.

The then Minister of Economy, Alejandro Gil, attempted to justify the strategy by stating that the goal was to achieve "an exchange rate that balances the economy."

Yet, in practice, the new scheme proved inefficient: the State sold only a minuscule fraction of what it collected, imposed limits on sales, and waiting lists became interminable.

Thus, the official exchange rate became irrelevant in the face of the real market dynamics.

In this context, the promised "orderly and transparent" market remains an unfulfilled goal, while the informal rate—the only one that somewhat accurately reflects the economic pulse on the street—continues to be compiled and published by elTOQUE, much to the government's dismay.

Accusations of "Financial Terrorism" and Official Propaganda

The Central Bank’s statement is part of a broader state harassment campaign against elTOQUE.

The independent outlet is being accused by the regime of orchestrating a supposed "financial terrorism" scheme aimed at triggering the country's economic collapse.

It all began on October 29, when Foreign Minister Bruno Rodríguez claimed there was "evidence of speculative manipulation of the exchange rate."

Days later, state media spokesperson Humberto López reiterated the accusation on his program Razones de Cuba, alleging that elTOQUE is part of a "comprehensive economic warfare program" funded by the United States.

López accused the outlet of "depressing the income level of the Cuban population," "promoting a foreign currency trafficking scheme," and committing "tax evasion."

He even suggested the possibility of criminal proceedings against its members, proposing that the outlet be included on a list of entities "linked to terrorism."

ElToque's Response: "The Earth is Spherical and the Elephant Remains in the Room"

The response from elTOQUE was swift. With an ironic and defiant tone, the outlet dismantled the regime's accusations.

It mocked the official propaganda narrative and defended its journalistic work as an exercise in transparency for a citizenry deprived of reliable data.

"There is more rationality in those who believe the Earth is flat than in those who place blind faith in Humberto López and the Cuban National Television News," the article quipped with irony.

It also argued that publishing the informal exchange rate "is not financial terrorism; it's a public service" and that blaming an independent media outlet for the structural crisis of the Cuban economy is a way to evade political responsibility.

As a closing note, the outlet warned of a potential official blockade of its website and offered alternatives to stay informed through mobile apps and social media.

A Regime Afraid of Transparency?

The Central Bank's attack comes amid a severe economic and social crisis in Cuba, marked by runaway inflation, food shortages, collapsed services, and massive emigration.

In this context, the existence of independent sources like elTOQUE poses a threat to the state propaganda apparatus, which has lost credibility among large segments of the population.

The regime's strategy seems clear: discredit those who expose reality, create an external enemy to blame for the disaster, and try to regain control over economic variables that it no longer manages.

Meanwhile, the Central Bank attempts to uphold the official narrative, insisting on the promise of an "objective" rate, even though it has failed to establish a functional currency exchange mechanism in reality.

The informal market, fed by distrust in the State, continues to be the only real reflection of the Cuban peso's value.

Ultimately, the Central Bank's attack on elTOQUE is not just a declaration of war against an independent outlet; it is also an admission of institutional failure to control an economy that has slipped beyond its grasp.

FAQs on Cuba's Economic Challenges and Independent Media

What sparked the Cuban Central Bank's offensive against elTOQUE?

The Central Bank's offensive is part of a broader campaign against elTOQUE, accusing it of manipulating exchange rates as part of a "financial terrorism" scheme allegedly aimed at destabilizing Cuba's economy.

Why is the informal market rate significant in Cuba?

The informal market rate is significant because it more accurately reflects the economic reality and the true value of the Cuban peso, unlike the official rate which has been criticized for being ineffective and unrepresentative.

How did elTOQUE respond to the accusations from the Cuban government?

ElTOQUE responded with irony and defiance, dismissing the accusations as unfounded propaganda and defending its publication of the informal exchange rate as a public service rather than financial terrorism.

What is the significance of the Central Bank's statement in the broader economic context of Cuba?

The Central Bank's statement underscores the regime's struggle to maintain economic control amid a severe crisis. It highlights the gap between official rhetoric and the economic realities faced by ordinary Cubans.